You can own some of the biggest public companies in the world, and many of them will pay you dividends when you own them. When you invest in stock, you can sell whenever you want since it’s a liquid investment. Here’s a list of other ways to invest, based on liquidity:

| Investment | Liquidity |

|---|---|

| Stocks | highly liquid, sell for cash whenever you want |

| Real estate (buying a house) | not liquid, it takes time to sell it for cash |

| buying a share of a housing development | not liquid, it takes time to untangle from the management |

| investing in a business | not liquid, getting investment back depends on contracts signed with the partners |

| Air Jordans | liquid, depending on how fast you can sell them |

If you have some cash that you would like to invest, one of the easiest ways to do it is to buy stocks. The quickest way is to start a Robinhood account on your phone, but i recommend starting a Roth IRA if you would like to save for retirement. I use TD Ameritrade, but you can use a different custodian like Schwab or OptionsTrader.

A Roth Individual Retirement Account (Roth IRA) will let your investments grow without being taxed, while a regular account will have your profits taxed at 35%, or 18% if you hold the investment for over 12 months. I just expect to withdraw my funds from the Roth when I’m 59 and then I never need to concern myself with the tax implications.

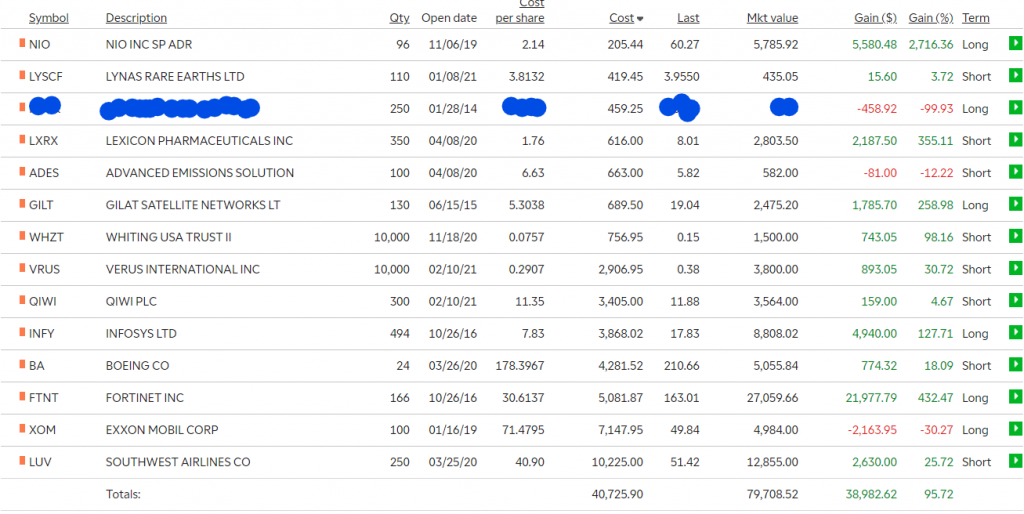

If your income is less that $120,000/year (which is most of the people I know), you can invest up to $6000 per year. I have invested a few thousand dollars every year since I was in my teens, and today i have around $80,000 in it. Here is a screen shot of what my portfolio looks like:

Let’s discuss each column headings, starting at on the left.

| Symbol | Known as the ‘ticker’, the symbol of the company for stock ownership |

| Description | Name of company |

| Quantity | the number of shares purchased |

| Open Date | When I bought the shares |

| Cost per Share | How much I paid per share when I bought them |

| Cost | Total cost, quantity x cost per share |

| Last | Current price of share |

| Market Value | current value of all the shares |

| Gain ($) | profit or loss in dollars |

| Gain (%) | profit or loss in a percentage ((market value-cost)/cost) x100 |

| Term | ‘long’ if over 12 months, ‘short’ for less than 12 months |

There are dozens of ways to choose stocks, here are a few:

| Tip | A friend or stranger says “buy this, do it because i did it” |

| value analysis | researching the worth of the company (book value) and comparing it to the value of the all the shares of stock. |

| trendlines | drawing a bunch of lines on the graph of the stock price, buying if you think price will return to a certain line. |

| dividend | buying stock that consistently pays a cash dividend, some retired people like this for their income. |

| screeners | selecting a bunch of criteria: industry, financial ratios, size of company, and then reviewing companies that meet your criteria |

| high hopes | considering if a company will have great future success, and buying now since it’s cheaper. |

| the papers | reading the business section of your local paper (or the Wall Street Journal) and look for articles about different public companies. |

Most of my stock picks come from tips and screeners. My screening criteria is usually high return on sales, high return on assets (ROA), small cap company (less than $1 billion in sales), and near their 52 week low price (the cheapest price all year).